How does the Stock Market Celebrate Christmas?

By Aaruni Gupta

Most people can agree that the Winter holidays are the most joyous and cheerful times of the year, especially since they come with a two-week vacation from school dedicated to celebrating the holidays with friends and family. It has become a staple of American culture, with the unmistakable signature colors of red and green, which, coincidentally, are the same colors the stock market operates on (though investors prefer to see green in their portfolio). Since the Winter holidays are often considered to be the highlight of the year, it is only natural that the stock market joins in on some of the fun, experiencing its ups and downs throughout the holidays.

One way that Christmas can benefit the stock market is through the “Santa Claus Rally”, a phenomenon in which stock prices rapidly increase, experiencing strangely low volume from Christmas through to New Years. In fact, since the 1960s, more than ⅔ of Decembers have been green for the markets. Even more miraculous is the statistic from 1969 to 2016, in which over 75% of Christmases were positive.

Pictured below is the S&P 500 during 2019 and 2020’s holiday seasons (respectively).

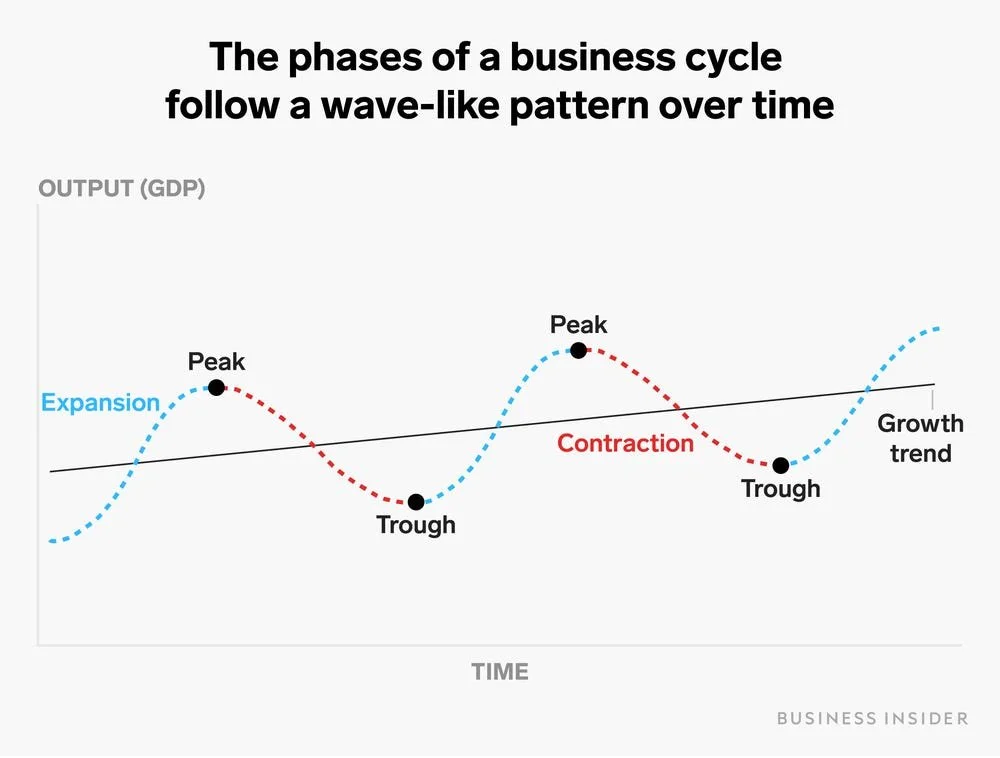

Could it be that the stock market is taking part in the holiday spirit? Investors have been working hard at theories to explain the magical phenomenon. It’s possible that increased shopping over the holidays generates more revenue for businesses, pushing share prices up. This occurs as a result of what is known as a business cycle, which categorizes how the economy performs over time.

Business cycles follow a wave pattern, bouncing between troughs and peaks. As people buy gifts for their loved ones (or treat themselves to a new videogame), the increased spending typically expands the business cycle to its peak.

Another theory is that the holidays simply make investors more optimistic about the markets, pushing share prices up as a result. A final theory is that the “Santa rally” is nothing but a coincidence. It’s not a secret that stocks tend to go up over time, so it makes sense that the majority of Decembers should be green. Typically, the rally occurs for a fundamental reason, not as a result of magic. For example, Joe Biden’s win in the 2020 presidential election caused one of the greatest stock market rallies ever seen, in which the S&P 500 gained 13% from November 2020 to January 2021. So, investors should know the reason behind the price movement in the markets before making any decisions with their money.

There are a few examples to show why it is so important to know the fundamentals of the stock market before placing faith in a “Santa rally”. Although the majority of Winter holidays have been green for the stock market, there are still several instances where the markets have experienced losses that would ruin any investor’s holiday just by looking at the chart. In stark contrast to the 2020 and 2019 winters, the 2018 holidays were blood red. Getting caught in a mess like 2018’s winter “holiday” is an investor’s greatest fear.

Pictured to the left is the S&P 500 during 2018’s Christmas.

It is quite evident that no “Santa rally” occurred here. The markets plunged over 2.5% on Christmas Eve, which makes the whole fiasco twice as painful. The decline occurred due to internal concerns with the stability of the US banking system as well as the looming US-China trade war that threatened to precipitate a global economic recession.

Proponents of the Santa Rally could argue that 2018 was an outlier in the broader scope of successful Christmas market rallies. But, if this is the case, could 2021 be another such outlier? With Christmas and New Years coming up so soon and the stock market looking so unstable, this holiday season may be just as red as 2018’s, especially with many of the concerns that investors have had in the past few weeks. In fact, just today (Monday, December 20th), the S&P 500 declined by 1% on the fear that Biden’s Build Back Better Act might not be approved.

The Omicron variant is one potential catalyst that could seriously get in the way of a potential Santa rally. According to the CDC, it is highly likely that the Omicron variant spreads more easily than any other variant of the virus, though it is not yet known whether or not it causes more severe symptoms. This lack of knowledge surrounding the Omicron variant is one reason why investors are hesitant to place money in the markets at this time. The situation could end in a couple of ways: the Omicron variant could cause the stock market to decline further if it turns out to be more dangerous than other variants, or the panic could subside if its severity barely outranks the common cold. Either way, many investors are not willing to take chances with their money.

Another reason why the Santa rally might not occur this year is the potential failure of President Biden’s Build Back Better act, which just encountered a serious roadblock Monday morning on December 20th as Senator Joe Manchin announced that he would not vote for the bill. Build Back Better was made to end climate change by cutting United States greenhouse gas emissions in half by 2030 and ending our contribution to climate change by 2050. However, all of these plans go to waste if Joe Manchin and other senators stand against the bill. Markets could go into shock if the act fails to become law, as fears of the Omicron variant would then be coupled with the impending doom of climate change. All in all, things won’t end well for the markets if Build Back Better fails. The Build Back Better act will be officially voted on by the Senate in January, so the uncertainty in the markets leading up to that point could ruin investor hopes of a Santa rally.

With the Omicron variant renewing the threat of Covid-19 and the Build Back Better Act on the brink of collapse, will this Christmas be an outlier like 2018’s Christmas catastrophe? At the end of the day, the only variable that can answer that question is time.

In essence, it is impossible to predict whether or not a Santa rally will occur, since this is basically just trying to time the markets (which you already know usually ends with a -99% return on a Robinhood account). The most important thing you can do is keep yourself up-to-date about what’s going on in the markets and do your own research about your investments so you can prepare for any potential market moves in advance.